Day trading isn’t a walk in the park. Some dream of turning it into a goldmine, but others end up with empty pockets. What makes the difference?

A clear plan and effective methods that don’t leave room for second-guessing. Before jumping in, let’s break it down into key steps and tips to help you keep the gains coming.

Table of Contents

Key Points

- Start with a demo account to practice without risk.

- Define a strategy and stick to it.

- Manage risk by limiting potential losses.

- Focus on realistic profit targets.

- Use tools and platforms that simplify execution.

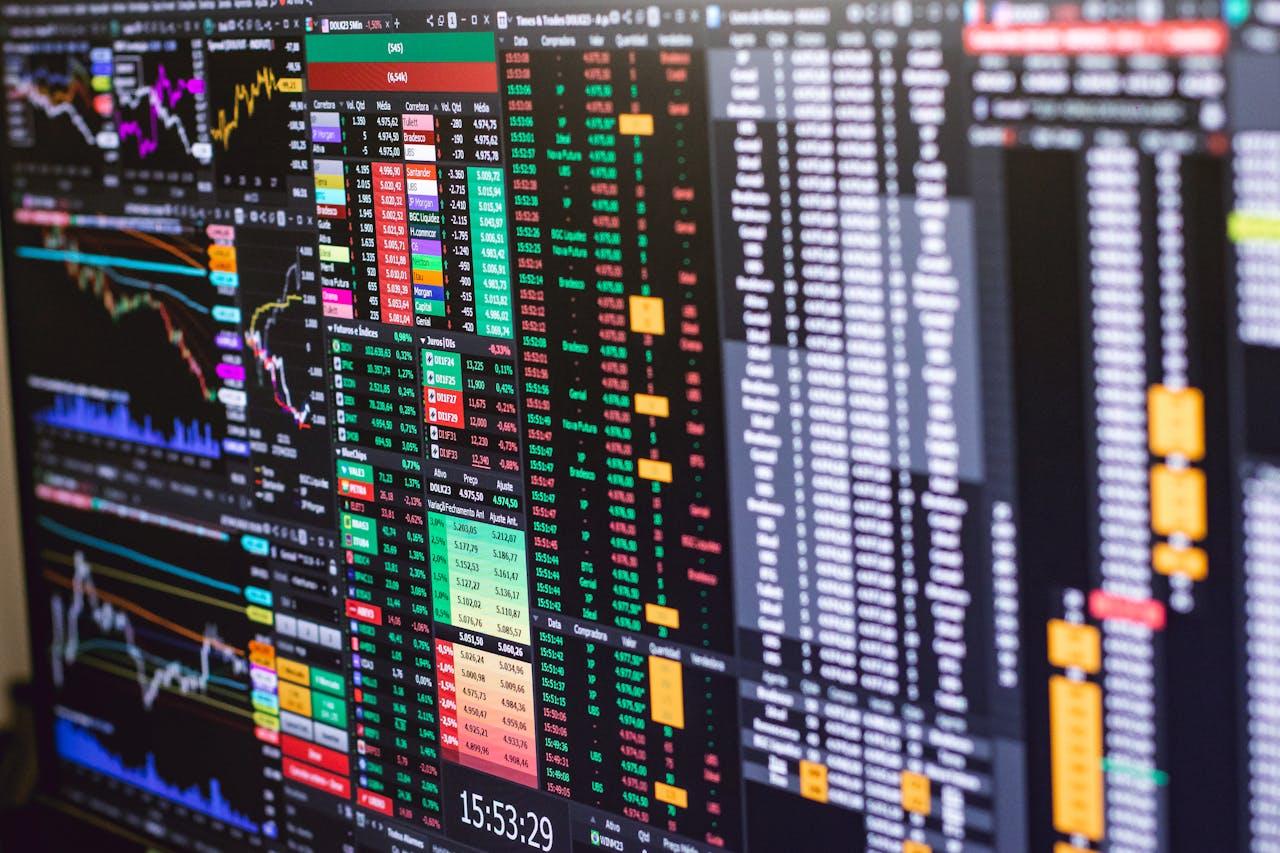

Why Tools and Platforms Make All the Difference

Success often hinges on choosing the right resources. Platforms like Binomo offer user-friendly interfaces and demo accounts, giving you the confidence to try different techniques before committing real funds. Practicing in a risk-free environment can help you avoid rookie mistakes.

Key Benefits of Using Reliable Platforms:

- Ease of Use: Simple interfaces reduce the learning curve.

- Risk-Free Practice: Demo accounts allow trial and error without financial loss.

- Multi-Position Options: Some platforms let you test multiple scenarios simultaneously.

Setting Up a Solid Foundation

Many jump into trading thinking they can figure it out on the go. The reality? Preparation is crucial. Start by:

- Educating Yourself: Learn market patterns and price movements. Study past trends to recognize common setups. Books, online courses, and webinars are excellent starting points.

- Establishing a Budget: Only trade with what you can afford to lose. This keeps emotions out of decisions and prevents devastating financial losses.

- Defining Your Goals: Are you looking for quick wins or building consistent income? Each goal requires a different approach. For instance:

- Quick wins may focus on high volatility opportunities.

- Consistent income demands discipline and patience.

Pro Tip: Break your goals into smaller milestones. For example, aim to grow your account by 2% weekly instead of chasing massive monthly gains.

Risk Management Rules You Can’t Ignore

The difference between pros and amateurs lies in protecting their capital. Follow these guidelines:

- Set Stop-Loss Orders: Decide how much you’re willing to lose on a single trade. For example, limit losses to 1% of your total capital.

- Don’t Chase Losses: Emotional decisions lead to bigger mistakes. If you’re down, step back and reassess.

- Limit Position Sizes: Keep investments small relative to your total capital. A good rule is to allocate no more than 5% per trade.

- Stick to a Ratio: Aim for a reward-to-risk ratio of at least 2:1. This ensures profitable trades outweigh the losses.

Practical Example: Imagine investing $100 per trade with a stop-loss at $90 and a target profit of $120. This setup means your potential gain is twice the potential loss, aligning with the 2:1 ratio.

The Power of Consistency in Execution

Experienced traders focus on consistency. Random decisions result in losses over time. Instead, concentrate on:

- Repeating Successful Patterns: Stick to setups you know well. For instance, if morning breakout trades work for you, don’t deviate.

- Monitoring Results: Analyze outcomes to identify what’s working. Keep a trading journal to track strategies, outcomes, and emotions.

- Minimizing Over-Trading: Quality beats quantity every time. For example, aim for two or three well-researched trades daily instead of ten impulsive ones.

Recommendations for Consistency:

- Use alarms to monitor key market moments.

- Take a break after a successful trade to avoid overconfidence.

- Review trades weekly to adjust approaches.

Different Methods to Keep Earnings Steady

Not all methods are created equal. Here are proven options worth exploring:

1. Momentum Trading

Capitalizing on fast-moving stocks works best with high volume. Look for sudden price shifts, then ride the wave for quick profits.

Steps to Implement:

- Identify stocks with high daily volume.

- Wait for a clear upward or downward momentum.

- Enter trades with tight stop-loss levels.

2. Breakout Techniques

Identify key levels of resistance or support. When the price breaks out, enter a position in the direction of the movement.

Key Benefits:

- Higher probability of success due to clear entry signals.

- Works across various time frames.

3. Reversal Approaches

For those who like going against the crowd, spotting when trends are about to reverse can yield significant rewards.

Pro Tip: Use oscillators like RSI or MACD to confirm reversal signals.

Using Data to Sharpen Your Edge

A histogram showing average success rates for different approaches can help you decide where to focus. Below is an example of how specific techniques compare:

| Method | Success Rate |

| Momentum | 65% |

| Breakout | 60% |

| Reversal | 55% |

Recommendations:

- Focus on methods with higher success rates initially.

- Use demo accounts to test each method and refine execution.

Why Emotional Control Is Essential

Markets test patience. Fear and greed lead to poor choices. Use these tips:

- Take Breaks: Step away to avoid impulsive decisions. For instance, if a trade isn’t working, pause instead of doubling down.

- Set Limits: Walk away after hitting your daily goal. This avoids unnecessary risk.

- Learn From Mistakes: Review errors objectively without frustration. For example, if you lose due to over-leverage, adjust future position sizes.

Building a Routine That Supports Long-Term Success

Consistency isn’t just about methods. Daily habits matter too. Here’s a suggested routine:

- Morning Prep: Review market news and set goals. Focus on stocks or currencies with significant announcements.

- Midday Analysis: Revisit performance and adjust plans. Ask yourself what’s working and why.

- End-of-Day Review: Log results and lessons learned. Reflect on emotional responses and their impact on results.

Practical Example: Suppose you trade from 9 AM to 12 PM daily. Spend 8:30 to 9:00 AM reviewing news and selecting stocks. At 10:30 AM, analyze progress and adjust for the last hour. Conclude at 12 PM with a performance summary.

Consistent Gains

Profitability doesn’t happen overnight. A structured approach, combined with discipline, turns aspirations into results. Stick to proven techniques, remain patient, and treat every decision as a learning opportunity. With practice, you’ll find your rhythm and create a sustainable path to earning.